Trendlines: Dump truck developments

04 September 2024

Dump trucks are proving to be a fluid sector, with several key changes in buying patterns and machine choices.

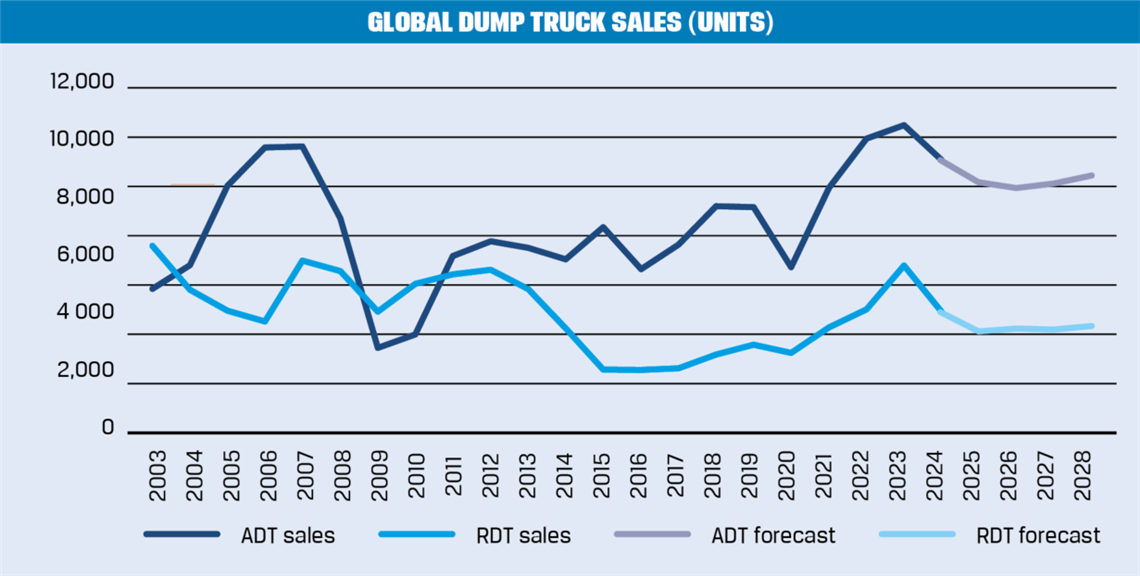

Sales of rigid and articulated dump trucks reached a 15-year peak in 2023, with more than 16,000 units sold worldwide. In the years since the last peak in the late 2000s, development of new products led to a shift in buying preferences.

Specifically, the introduction and acceptance of bigger articulated trucks in the 50- and even 60-ton capacities has eaten into the market for similarly sized rigid haulers in the same weight classes. Buyers have been swayed by the better off-road performance of articulated machines, which means money can be saved on maintaining haul roads for rigid trucks.

Source: Off-Highway Research

Source: Off-Highway Research

This meant that the previous market for rigid dump trucks, which had been around 5,000 to 6,000 machines per year in the late 2000s, fell to 2,000 to 3,000 machines per year in the 2010s. It should be added here that the global rigid dump truck market is a difficult one to size accurately as there have historically been many pockets of local manufacture in various parts of the world which are hard to accurately monitor.

Market Specific

It should also be added that articulated trucks are by no means a universal product. They are popular in Europe and North America in particular, along with certain other markets like Australia, Indonesia and South Africa. Notwithstanding the Indonesian market, their popularity has never been particularly high in Asia, particularly the biggest equipment markets of China and India.

But in areas where they are popular, they have prospered over the last three years and there has been a steady, long-term migration to bigger and bigger trucks.

Changing Landscape

Now the landscape is changing again with the emergence of so-called wide-bodied trucks (WBTs), popularized by a number of Chinese manufacturers. These are based on strengthened and improved on-highway chassis and are fitted with (wide) bodies that can accommodate up to 100 tons. In China, these have as good as wiped out the market for traditional rigid dump trucks under 100 tons.

Chris Sleight, managing director, Off-Highway Research.

Chris Sleight, managing director, Off-Highway Research.

There are limitations to these machines, of course. They cannot cope with steep haul roads and are not well-suited to long haul distances, and they also tend to go through a lot of tires. But in the right application, a price point of around a third of a traditional rigid truck means they are a compelling proposition.

Another interesting feature is that a large proportion of wide-bodied trucks are battery-electric, often with a swappable battery, which removes a lot of issues around downtime due to the charging requirement.

As China’s WBT manufacturers push harder and harder on exports, these machines are gaining acceptance and significant sales in emerging markets outside China. They are also starting to be offered by traditional off-road truck suppliers such as Develon (through an OEM supply agreement), and other international OEMs are known to be looking seriously at the concept.

MAGAZINE

NEWSLETTER

The gold standard in market research

Off-Highway Research offers a library of more than 200 regularly updated reports, providing forensic detail on key aspects of the construction equipment industry.

Our detailed insights and expert analyses are used by over 500 of the world’s largest and most successful suppliers, manufacturers and distributers, to inform their strategic plans and deliver profitable growth.