Interest rates are falling. So why is European construction still in the doldrums?

11 November 2024

Facade specialist Seele is installing the skylights in the future central station at Stuttgart central station in Germany (Image: IMAGO/Arnulf Hettrich via Reuters Connect)

Facade specialist Seele is installing the skylights in the future central station at Stuttgart central station in Germany (Image: IMAGO/Arnulf Hettrich via Reuters Connect)

With the spotlight firmly on Donald Trump’s victory in the US presidential election, you could easily have missed some significant news last week about Germany’s government collapsing.

Germany’s embattled Chancellor Olaf Scholz sacked finance minister Christian Lindner unexpectedly from a three-way coalition. It sets the stage for an election in Germany in March 2025.

Further political upheaval is unlikely to do much for the state of mind of Germany’s construction company bosses, who remain deeply pessimistic about the sector’s prospects, according to a set of new surveys gauging how construction buyers see the state of play.

In fact, the malaise continues to extend to another of Europe’s major economies, France, even as the cost pressures that have made life so difficult for the construction section appear to be subsiding and the European Central Bank (ECB) instituted a 25-basis-point interest rate cut in October.

European construction still in the doldrums

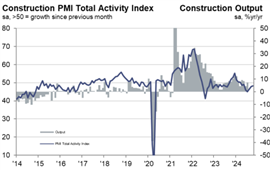

Construction activity in the Eurozone declined once again at the start of the fourth quarter of the year (October), according the new Hamburg Commercial Bank (HCOB) PMI survey data on the region.

A score of 43.0 (where 50.0 indicates no change) on the HCOB Eurozone Construction PMI Total Activity Index may have been better than the 42.1 registered in September, and the slowest decline since December 2023, but it was a fall in output nonetheless.

The level of new orders also fell over the period. The downturn in activity across the Eurozone remains broad-based, with all three subsectors of construction – commercial, civil engineering and particularly residential – in decline.

The fact that cost pressures on construction companies reduced in October, with input price inflation at its lowest level since July 2023, should come as good news but it’s also an indication of waning demand.

Subcontractor rates also fell for the second month running and subcontractor availability has risen for two months in a row.

Eurozone construction companies remain pessimistic for the coming year and foresee further drops in activity on the horizon, according to the HCOB PMI Eurozone survey. Sentiment fell again in the second month running and is at its lowest level in 2024 so far.

Sources: HCOB, S&P Global PMI.

Sources: HCOB, S&P Global PMI.

Germany the ‘problem child’

Problems remain particularly acute in Germany, which Dr Tariq Kamal Chaudhry, economist at HCOB, described as the Eurozone’s “problem child”.

October saw slightly faster decreases in both activity and new orders in Germany, as well as another round of staff retrenchment.

The seasonally adjusted index tracking changes in total industry activity fell to a score of 40.2 in October. That was down from September’s 16-month high of 41.7, although that was itself still indicative of a decline in activity.

Once again, Germany’s housing construction sector saw the steepest rate of contraction, followed by the commercial sector. But the fall in activity also accelerated in civil engineering in October.

The survey reported a scaling back in purchases of construction materials, as well as a substantial reduction in the usage of subcontractors. The availability of subcontractors improved and the rates they charge dropped at the sharpest rate in 12 years, suggesting that they are struggling to find work.

Meanwhile, sentiment among German construction companies is low – the second-weakest level in October for the year so far. They reported being pessimistic about the state of the wider economy, the cost of borrowing, and political uncertainty – and that was before Germany’s government collapsed.

Jonas Feldhusen, junior economist at HCOB commented, “The downturn in Germany’s construction sector intensified in October. Analysing the headline activity index, one could identify a tentative trend reversal during the summer months up until September. However, the latest survey results contradict this interpretation, unfortunately indicating that there is still no sustained improvement in the German construction sector. This impression is reinforced by a further significant drop in new orders in October.

“A comprehensive fiscal stimulus program would certainly benefit the industry. However, a robust program capable of providing investment security is unlikely to be forthcoming from the current government,” he added.

Last week, Germany’s federal government unveiled changes to its building regulations in a bid to ease the regulatory burden on housebuilders - another area where construction companies have been asking for change. The new Act seeks to make regulations on matters outside of structural stability and fire protection less prescriptive.

The government has approved the draft law for the ‘Building Type E Act’, which federal minister for housing, urban development and construction Klara Geywitz said would reduce bureaucracy and make adjustments to contract law to encourage simple and more cost-effective construction.

Separately, the government has finalised a guidance document called ‘Building Simply’ that forms the foundation for cooperation on Building Type E.

“Our aim is to continue to build high quality buildings in the future, while at the same time becoming faster and cheaper, because the need for living space remains high,” said Geywitz.

Sources: HCOB, S&P Global PMI, Eurostat

Sources: HCOB, S&P Global PMI, Eurostat

France’s decline in activity slows

HCOB’s Construction PMI Total Activity Index for France stayed in negative territory during October – the 29th month in succession.

It scored 42.2 for the month, although that was a considerable improvement on the 37.9 registered in September and signalled the slowest rate of decline since May.

There were weaker falls in activity in both the housing and civil engineering segments while residential activity decreased at the softest pace for 10 months.

Unfortunately, there was a “marked deterioration” in demand for construction work across the country in October, with reports of fewer calls for tender, competition, and lower new orders from public sector clients.

That has resulted in French constructors buying in fewer materials and reducing their workforce capacity at the sharpest rate since July.

Dr, Chaudhry said, “The French construction sector remains deeply entrenched in a crisis, even though the pace of decline slowed somewhat in October. The civil engineering sector is showing the most significant progress toward stabilisation, while commercial construction continues to face challenging conditions. The situation in the residential sector remains particularly tense, and it still recorded the weakest performance among the sub-sectors.”

Offering a rather downbeat assessment, he warned, “No hope for growth is in sight. While the French construction sector recorded a noticeable slowdown in its contraction in October, it remains in a precarious position. Order intakes declined rapidly, and expectations for future activity over the next twelve months are subdued.”

Sources: HCOB, S&P Global PMI.

Sources: HCOB, S&P Global PMI.

Italy’s downturn eases

The picture in Italy looks a little better, as declines in activity and new orders slowed. The headline HCOB Italy Construction Purchasing Managers’ Index rose slightly from 47.8 in September to 48.2 in October.

Some companies claimed that subdued demand for construction has been behind a decline in activity since May, while others pointed to adverse weather conditions affecting how much work they could get done.

The survey’s panellists also mentioned that there was still uncertainty among clients over economic conditions that is affecting new orders to an extent.

But as in other regions, lower demand has helped to ease cost pressures, which did rise in October but at the slowest rate for nearly four and a half years.

“One positive development is the trend in new orders for Italy’s construction sector. The index now hovers barely in contraction territory, indicating that incoming orders in October did not experience the same drop as in previous months. However, customers are reportedly still holding back due to ongoing economic uncertainty, prompting companies to continue reducing their purchasing quantities,” Feldhusen said.

Sources: HCOB, S&P Global, ISTAT via S&P Global Market Intelligence

Sources: HCOB, S&P Global, ISTAT via S&P Global Market Intelligence

Firms face a wait for more interest rate cuts

As Germany’s construction industry association Bauindustrie previously indicated to Construction Briefing earlier this year, for the gloom spreading across its and the wider Eurozone construction industry to lift, it wants to see further interest rate cuts.

That would potentially have a positive effect on residential construction markets that are struggling, particularly in Germany, France and northern parts of Europe.

But after the 25-basis-point reduction in October, the prospect of any further interest rate reductions could be some way off.

“From the industry’s perspective, a substantial rate cut by the ECB would be welcome in the coming months. However, annual consumer price inflation in the Eurozone rose to 2% in October 2024, up from 1.7% in September. Given the inflationary risks, the ECB is likely to proceed with caution,” Chaudhry said.

The ECB said as much itself last month when it cut rates. Its governing council warned, “The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. It will keep policy rates sufficiently restrictive for as long as necessary to achieve this aim.”

All this could mean more pain for construction, at least in the short term.

“The outlook for the construction sector remains bleak. New orders have once again fallen sharply from the previous month, staying firmly in contraction territory. Particularly concerning is the rapid deterioration in future activity expectations, which are declining at an unprecedented rate since data collection began and are now at extremely low levels,” said Chaudhry, as he commented on the latest Eurozone PMI figures.

UK activity still growing

November saw a 0.25% cut in interest rates by the Bank of England but the pace of further cuts could be fairly slow here too.

Where the UK differs to the Eurozone is that the S&P Global UK Construction PMI shows that activity there is still growing.

That was in spite of a renewed decline in housebuilding in the UK in October. Civil engineering remained the best-performing segment, followed by commercial work.

The headline index recorded a score of 54.3 in October, down from 57.2 in September, marking the eighth consecutive month of growth.

New work also grew at a solid pace, although political uncertainty and cost-of-living pressures were cited by survey respondents as the factors limiting further new order growth in September.

UK construction companies are also hiring more people thanks to the growth in new orders, even as business optimism regarding growth prospects for the year ahead declined.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM