OHR forecasts soft landing for global construction equipment

01 May 2023

Global construction equipment sales fell 7% last year from the record high established in 2021, according to Off-Highway Research’s Global Market Review. The downturn was entirely due to the collapse of demand in China. Sales in the world excluding China grew 7% in 2022.

Off-Highway Research’s forecast is for a 7% decline in global sales in 2023. This is a slightly steeper downturn than envisaged a year previously, due to the weakness of the Chinese market. Stripping China out of the equation, the remaining countries of the world will only see a 5% downturn overall.

Off-Highway Research would still classify the 2022-2025 downturn as a soft landing. Only single-digit year-on-year declines in equipment sales are expected, and the volume of machines sold throughout the forecast period should stay above 1 million units per year. Prior to the current upswing, such a volume was only achieved twice before.

The forecast is based on the premise that infrastructure investment will be strong, and that although interest rates are rising, they will only slow residential construction down rather than push it over a cliff.

However, there are risks to the forecast and they are almost entirely on the downside. Inflation was a serious issue throughout 2022, and although improving, it remained too high in early 2023. Add to that the war in Ukraine, which continues to heighten inflationary pressures worldwide and is therefore also exerting upward pressure on interest rates.

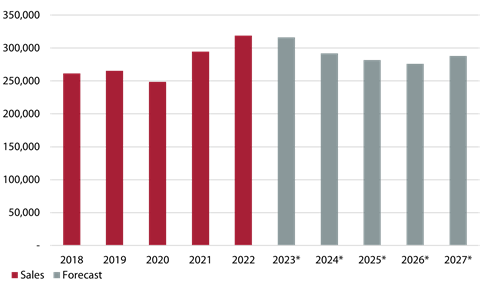

North America – the pick of the bunch

North America was the best performing of the major markets in 2022, with an 8% increase in sales to take demand to a record high of 318,855 machines sold. Compact track loaders are now firmly established as the most popular equipment type in the region and mini-excavator sales have also grown to a significant level. Sales of these machines have largely been at the expense of skid-steer loaders and backhoe-loaders.

Although a modest 1% decline in sales is expected this year, the market will still enjoy the second highest volumes ever seen. The long lead times for equipment mean that suppliers are confident of sales well into the third quarter of the year, even though rising interest rates are starting to cool off the housing market.

While this is expected to lead to a fall in sales of smaller equipment types, infrastructure investment is on the rise in the region, thanks in part to the stimulus plans which were put in place during the pandemic years.

By their nature, machines used in infrastructure construction are higher value/lower volume than the compact equipment sales which are driven by residential building. This is therefore expected to lead to a shallow dip in sales from 2023-2026. However, North America suffers from a shortage of housing, and this is expected to stimulate an upturn in compact equipment sales toward the end of the forecast period.

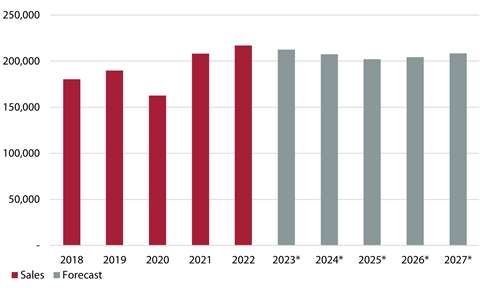

Europe to stay on a high

Construction equipment sales in Europe rose 4% in 2022 to 216,861 units. This increase from 2021’s already high level of 208,288 machines sold maintained the market at a high level, and comparable with the previous record set in 2007.

The strongest growth in 2022 was seen in the larger markets of Southern Europe – most notably Italy, which saw sales rise an impressive 18%, while Spain’s 17% growth was also well above average. France also performed well with an 8% rise in sales, thanks to broad demand for both heavy and compact equipment.

Growth in the UK was more subdued at 4%, but the volume of equipment sold was the highest ever seen. Meanwhile the German market declined 1%, but this must be seen in the context of the extraordinarily high number of machines which have been sold in the country in the last four to five years.

Off-Highway Research’s forecast for Europe is essentially for the market to stabilize at a high level. Although single-digit percentage annual declines in sales are expected for the next three years, the market is forecast to remain above 200,000 units over the medium term. Prior to the current peak, a volume above 200,000 machines sold was only achieved once before for a single year in 2007.

A slowdown in homebuilding due to rising interest rates represents a threat to compact equipment sales. However, Europe’s infrastructure markets are strong, which should stimulate sales of larger earthmoving equipment.

Off-Highway Research’s Global Market Review is available now to all subscribers. The report can also be purchased by non-subscribers here.

A full discussion on the state of the North American construction equipment market and the outlook to 2027 is available to subscribers to Off-Highway Research’s North American Service and North American Database Service. A full discussion on the state of the European construction equipment market and the outlook to 2027 is available to subscribers to Off-Highway Research’s European Service and European Database Service. Additional discussions are available for both China and India.

For information about Off-Highway Research’s subscription packages. reports and data, contact [email protected].

MAGAZINE

NEWSLETTER

The gold standard in market research

Off-Highway Research offers a library of more than 200 regularly updated reports, providing forensic detail on key aspects of the construction equipment industry.

Our detailed insights and expert analyses are used by over 500 of the world’s largest and most successful suppliers, manufacturers and distributers, to inform their strategic plans and deliver profitable growth.