U.S. LNG exports rose 9% in 2022

28 March 2023

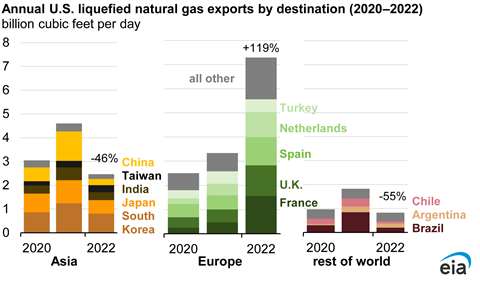

U.S. exports of LNG rose 9% last year, driven by strong demand in Europe, high international gas prices and growing liquefaction capacity in the U.S. Europe was the largest importer of LNG from the U.S. and saw its volumes climb 141%, or 4.0 Bcf/d, from 2021, a recent report shows.

The U.S. exported an average of 10.6 Bcf/d in 2022, according to the latest Natural Gas Monthly from the U.S. Energy Information Administration.

U.S. LNG exports to Europe, which includes the European Union plus the United Kingdom, rose in response to natural gas supply challenges in Europe after Russia’s pipeline exports fell to 40 year lows, which pushed prices for natural gas in Europe higher than other trading hubs.

Europe became the primary destination for U.S. LNG exports in 2022, accounting for 64% (6.8 Bcf/d) of total exports. Four countries—France, the U.K., Spain, and the Netherlands—accounted for a combined 74% (5.0 Bcf/d) of U.S. LNG exports to Europe, the EIA reported.

European imports of LNG last year rose to an all-time high of 14.9 Bcf/d, up 65% (5.9 Bcf/d) from 2021, according to data from Cedigaz. Three countries—the United States, Qatar, and Russia—provided 73% (10.8 Bcf/d) of Europe’s LNG imports in 2022. Excluding intra-regional trade, the remaining 3.8 Bcf/d of LNG imports was supplied by 14 other LNG-exporting countries. Europe’s LNG import capacity expanded in 2022, and we expect it to grow again by the end of 2024 by one third. Europe is adding new LNG regasification terminals and expanding existing facilities.

As U.S. LNG exports to Europe rose, its exports to Asia fell by 46%, or 2.1 Bcf/d, to an average of 2.5 Bcf/d last year.

Most countries in Asia reduced LNG imports from the United States in 2022. The most notable reduction was in U.S. LNG exports to China, which plunged 78% (1.0 Bcf/d). China’s annual LNG imports from all countries declined 20% (2.1 Bcf/d) in 2022 compared with 2021 and averaged 8.4 Bcf/d—the lowest level since 2019, according to data from China’s General Administration of Customs.

U.S. LNG exports to eight countries in Latin America declined by 62% (1.1 Bcf/d) in 2022. The largest decline was in exports to Brazil—by 77% (0.6 Bcf/d)—as increased availability of hydroelectric power reduced natural gas demand for electricity generation at Brazil’s natural gas-fired power plants. In 2022, Kuwait was the only country in the Middle East that imported U.S. LNG, with exports averaging 0.2 Bcf/d, or twice 2021 levels, the EIA reported.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM